Emerging Trends in Facial Aesthetic Procedures in Thailand: A 2025 Perspective

In 2025, Thailand’s beauty industry continues its dynamic evolution, with facial aesthetic procedures standing out as one of the most rapidly expanding segments. This surge is not merely a trend — it reflects a broader shift in consumer values, where appearance, self-care, and preventive aesthetics have become deeply integrated into modern lifestyles.

Several key drivers are fueling this growth: cutting-edge medical technologies, rising disposable incomes, increased health and beauty awareness, and the ever-powerful influence of social media. Particularly among Millennials and Gen Z, the desire for natural yet enhanced beauty has reshaped the demand landscape in clinics across the country.

Thailand’s Booming Aesthetic Medicine Market: Key Trends and Insights

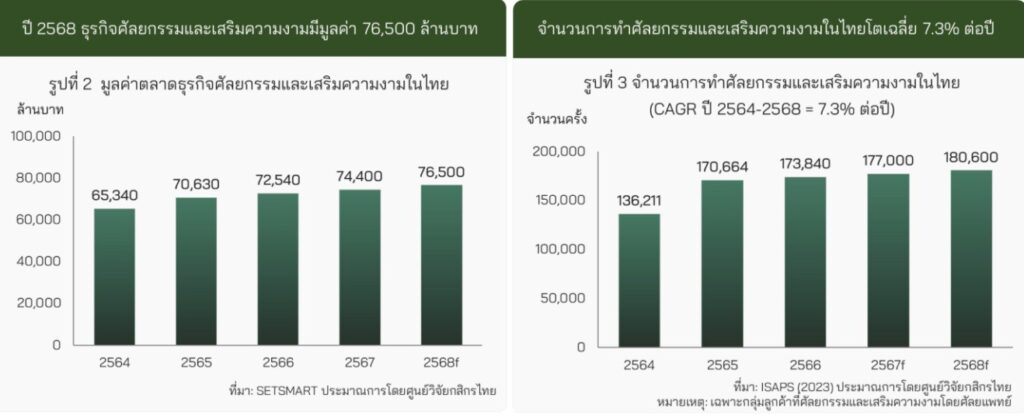

In 2025, Thailand’s cosmetic and aesthetic surgery market is projected to reach a total value of THB 76.5 billion, marking a 2.8% growth compared to the previous year. This modest increase is driven by a steady rise in the number of procedures, as well as higher service and treatment fees.

Despite the growing interest in non-invasive treatments, surgical procedures still dominate the market—accounting for more than 79% of total cosmetic interventions in the country. Facial surgeries continue to be the most in-demand, reflecting ongoing consumer preferences.

The customer base is also expanding and diversifying, with emerging demand from:

• LGBTQIA+ communities

• Gen Z consumers

• Male clients who are increasingly conscious of their appearance

However, growth in 2025 remains relatively flat compared to previous years due to macroeconomic headwinds, limited purchasing power, and intense market competition. These factors have tempered the momentum seen in earlier years.

When looking at profitability, the average Net Profit Margin (NPM) for businesses in this sector has declined post-COVID. Between 2021 and 2023, the NPM averaged 2.3%, down from 2.7% during the pre-COVID period (2017–2019). This decline highlights a highly competitive landscape, with numerous players—especially large, well-established brands—gaining market share through strong branding, investment in advanced technologies, and access to top-tier medical professionals.

Figure 1 (source: Kasikorn Research Center, 2025)

Facial Injection Trends in Thailand: How Thai Consumers Approach Aesthetics in 2025

In 2025, facial injections have become a normalized part of self-care routines in Thailand, with a growing number of people embracing aesthetic enhancements—not for dramatic transformations, but to refine and preserve their natural beauty. Once perceived as exclusive or taboo, injectables are now viewed as essential beauty maintenance, much like facials or hair treatments.

- Facial Injections Are Now Mainstream

Injectable treatments like Botox, dermal fillers, and mesotherapy are no longer seen as extreme or only for the wealthy. Aesthetic procedures are now part of everyday beauty routines, with many Thais planning regular touch-ups every few months to maintain a fresh, youthful look.

- Emerging Consumer Segments: Gen Z and Male Clients

While Millennials and Gen X remain the core demographic, Gen Z is becoming an increasingly important market. Many younger clients are turning to aesthetic medicine not to reverse aging—but to prevent it before it begins.

Meanwhile, male participation in the aesthetic market is rising steadily, particularly for jawline enhancement, chin contouring, and overall facial balancing—treatments that deliver a polished look without obvious signs of work.

- Diversity & Identity: LGBTQIA+ Leading the Way

Thailand’s inclusive beauty culture continues to support the LGBTQIA+ community, which remains one of the most engaged and loyal consumer groups for facial injectables. This segment not only embraces aesthetic treatments but also drives demand for personalized, gender-affirming beauty approaches.

- The “Natural Look” Reigns Supreme

One of the most significant shifts in consumer behavior is the preference for subtle, natural-looking results. Gone are the days of exaggerated cheeks and overfilled lips. Today’s clients seek balance, proportion, and harmony—enhancements that refresh the face while retaining individuality. The phrase “looking like you haven’t had anything done” is now a key beauty goal.

- Informed Consumers, Higher Expectations

With more knowledge and access to information, Thai consumers are more discerning than ever. They research brands of injectables, scrutinize before-and-after photos, and prioritize certified clinics with skilled professionals. Trust, transparency, and authenticity are essential to attracting and retaining clients in this market.

- Price Still Matters—But Value Matters More

While price sensitivity is present, consumers are not simply seeking the cheapest deal. Instead, they look for the best value—a balance between quality, safety, service, and visible results. Many are open to treatment packages or loyalty plans from trusted clinics, especially those offering long-term care and consistent follow-up.

Facial injectables in Thailand are no longer just a cosmetic option—they’re a cultural shift toward preventive beauty, confidence, and personal identity. For brands, clinics, and practitioners, understanding these evolving preferences is key to capturing and keeping consumer trust in this fast-growing aesthetic space.

Insight: Thai Consumers’ Most Preferred Facial Procedures in 2025

Based on interviews with over 30 aesthetic and dermatology doctors conducted by Illuminati Research Thailand

From an average of 300 consultation cases and 200 actual treatment cases per clinic per month, the most popular facial injection treatments among Thai clients are as follows:

- Botox — Most Chosen Procedure

• 130+ cases/month

• Used for wrinkle reduction, jaw slimming, and facial contouring

• Doctors report it as the first choice for both first-time and repeat patients

• Preferred for its quick results and minimal downtime - Filler Injections

• Approx. 40 cases/month

• Common areas: under eyes, cheeks, lips, chin

• Growing interest in natural-looking results and facial harmonization - Vitamin Skin Boosters

• Approx. 15 cases/month

• Clients seek brighter, more hydrated skin

• Often used by working professionals and those with busy lifestyles - Collagen-Stimulating Injections (e.g. PDRN, Sculptra)

• Approx. 15 cases/month

• Aimed at improving skin texture, elasticity, and long-term firmness

• Favored by clients who prefer gradual, long-lasting rejuvenation

Key Takeaway:

Botox remains the leading injectable treatment in Thailand’s aesthetic market in 2025, accounting for over 65% of all injectable facial procedures per month, followed by fillers and skin-rejuvenation boosters. This reflects a strong consumer preference for visible yet subtle enhancements with minimal recovery time.

Most Popular Injectable Brands in Thailand’s Aesthetic Clinics (2025)

In 2025, Thailand’s aesthetic scene continues to thrive, with facial injectables leading the way in both popularity and innovation. Based on insights from Illuminati Research Thailand, gathered from interviews with over 30 board-certified aesthetic and dermatology doctors, the following four categories have emerged as the most in-demand: Botox, dermal fillers, vitamin injections, and collagen-stimulating injectables.

- Botox – The Timeless Classic

Botulinum toxin treatments top the charts, with over 130 out of 200 injectable clients per month choosing Botox to smooth wrinkles, slim facial features, and enhance symmetry. The most trusted brands used in Thailand include:

• Botox® – USA: Industry gold standard with predictable results and long-lasting effects.

• Xeomin® – Germany: A purified formula with no complexing proteins; ideal for repeat users.

• Nabota® – South Korea: Fast-acting and cost-effective; gaining traction in mid-range clinics.

• Aestox®, Hugel® – South Korea: Increasingly popular for their affordability and decent efficacy.

- Dermal Fillers – Volume, Shape, and Lift

Used by around 40 patients per clinic per month, dermal fillers are a go-to for enhancing lips, lifting cheeks, and refining jawlines. Top filler brands in Thai clinics include:

• Juvederm® – USA: Known for smooth texture and longevity (12–18 months); perfect for lips and mid-face.

• Restylane® – Sweden: Offers firmer texture, suitable for contouring and facial definition.

• Neuramis® – South Korea: Popular among younger consumers for affordability and good consistency.

• Belotero® – Germany: Gaining traction in premium facial sculpting procedures.

- Vitamin Injections – Inner Glow, Outer Radiance

Roughly 15 patients per month per clinic choose vitamin cocktails and skin-boosters to brighten their skin and combat dullness. Commonly used brands or formulas include:

• Aura White – Thailand: A clinic-made cocktail often containing glutathione, vitamin C, and CoQ10.

• Snow White – South Korea: High-dose glutathione formula; popular for brightening and detox.

• Meso White / Custom Skin Boosters – Various origins: Tailor-made solutions that hydrate and lighten the skin.

💡 Most Thai clinics use signature or customized formulations tailored to client needs and branding.

- Collagen-Stimulating Injectables – Subtle Yet Powerful

While still a smaller market, collagen-boosting injectables are steadily growing in demand, especially among anti-aging clients. Trusted products in this segment include:

• Sculptra® – USA: Uses PLLA to gradually stimulate natural collagen for long-term volume restoration.

• Radiesse® – USA: Combines immediate volume with calcium-based collagen stimulation.

• Rejuran® Healer – South Korea: Derived from salmon DNA (PDRN); ideal for healing acne-prone or sensitive skin.

• Rejuran i / S / HB – South Korea: Variants targeting under-eyes, acne scars, and hydration, respectively.

Why It Matters :

Thailand’s injectable market is shifting toward quality, customization, and preventative care. Consumers today are highly informed, brand-aware, and result-oriented—whether they’re young Gen Z clients trying skin boosters for the first time or professionals looking for subtle rejuvenation. The growing number of trusted international brands reflects the demand for both safe and sophisticated beauty solutions in the Thai market.

Key Risks in Thailand’s Aesthetic and Cosmetic Surgery Industry

While Thailand’s aesthetic and cosmetic surgery sector continues to grow, driven by rising demand from both local and international clients, the industry faces significant structural and competitive challenges:

- Limited Supply of Qualified Medical Professionals

Thailand has a relatively low number of certified plastic surgeons—around 500 in total—compared to key competitors like South Korea, which boasts over 2,700. This shortage fuels intense competition for talent, driving up operational costs. For example, there are only around 100 facial plastic surgeons in the country, making it difficult to meet increasing demand.

- Intensifying Market Competition

The domestic market is becoming increasingly saturated, with more than 2,500 clinics in operation—many of them small-scale. Economic uncertainty further adds pressure on businesses to maintain revenue and expand their client base.

Moreover, international players are entering the Thai market or attracting Thai customers to undergo procedures abroad, particularly in South Korea, which remains a preferred destination for its reputation and expertise in aesthetic surgery.

- The Challenge of Investing in Beauty Technology

Aesthetic businesses must continuously invest in new technologies and treatment devices to keep up with fast-changing beauty trends. While innovation can attract customers, inconsistent or low customer volume can make it difficult to manage costs and maintain profitability.

This is especially true for businesses targeting the middle- to lower-income segments, where clients often prioritize price and value. These customers tend to carefully compare cost versus benefit before committing to treatments.

Figure 2 (source: Kasikorn Research Center, 2025)

Growth Opportunities in the Beauty and Aesthetic Industry

- Expansion through Medical Tourism

Thailand is a top destination for aesthetic treatments thanks to skilled professionals, competitive pricing, and quality services. This creates strong potential for attracting more international clients, particularly from ASEAN countries, China, and the Middle East.

- Rising Demand from Male Clients

Men are increasingly investing in personal grooming and appearance. Services like laser hair removal, facial skincare, and facial contouring for men are gaining popularity and offer new avenues for business growth.

- Preventive and Long-Term Aesthetic Care

Consumers are shifting towards preventive care at a younger age, seeking treatments like Botox, fillers, and skin boosters to slow signs of aging early. This trend supports long-term client retention and recurring revenue.

- Integration of AI and Digital Tools

Emerging technologies such as AI-driven facial analysis, AR for visualizing treatment results, online booking platforms, and personalized CRM systems help enhance customer experience and build trust.

- Personalized and Specialized Services

Clients are increasingly seeking customized solutions that cater to their unique skin and beauty needs. Clinics offering tailor-made programs and personalized skincare products are well-positioned for future growth.

- Targeting Gen Z and First-Jobbers

Younger generations are entering the beauty market earlier and are willing to spend on services that boost confidence and personal branding. This group presents a strong long-term growth segment.

Future Trends in Thailand’s Beauty Industry (2025 and Beyond)

Thailand’s beauty and aesthetic industry is experiencing unprecedented growth—shaped by innovation, shifting consumer behavior, and a broader understanding of beauty and wellness. Here are the top trends and future insights that entrepreneurs and marketers should watch closely.

1. Sustained Growth & Market Expansion

According to data from the Department of Business Development (DBD), Thailand currently has over 6,600 registered beauty businesses with a combined capital of 190 billion baht. The market revenue reached 363 billion baht in 2023 and continues to grow steadily, driven by increasing demand across all demographic groups.

Figure 3 (source: Department of Business Development, 2025)

2. Tech-Enhanced Personalization with AI & AR

Thai beauty clinics are embracing AI-powered diagnostics and Augmented Reality (AR) to offer hyper-personalized skincare consultations. Virtual try-on features are becoming a norm in product selection and service previews.

3. Social Commerce & Influencer-Driven Marketing

Thai consumers discover new beauty trends through TikTok, YouTube, and Instagram. Influencer marketing and “viral” campaigns have become crucial for driving sales and brand awareness—especially among Gen Z.

4. Scientific Wellness & Holistic Aesthetic

Beyond skincare, Thai clinics are offering wellness services—from IV therapy and hormone balancing to anti-aging medicine and personalized supplements. Consumers increasingly seek beauty from the inside out.

As beauty becomes more personalized, inclusive, and tech-driven, Thailand’s beauty industry is positioned to lead Southeast Asia in innovation and consumer experience. Clinics, brands, and entrepreneurs who embrace these shifts will thrive in the years ahead.